is yearly property tax included in mortgage

Property taxes are usually included in your. The mortgage the homebuyer pays one year can increase.

Paying property taxes is inevitable for homeowners.

. If you get a home. Ad Learn More About Mortgage Preapproval. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes.

Paying property taxes is inevitable for homeowners. Ad See Todays Rate Get The Best Rate In A 90 Day Period. If your county tax rate is 1 your property tax bill will come out to.

Assessed value x property tax rate property tax Lets say your home has an assessed value of 100000. Are Property Taxes Included In Mortgage Payments. No way Im finding a 2 bedroom at that price to rent anymore.

The monthly mortgage payment you send contains a share of the. Take Advantage And Lock In A Great Rate. The tax is based on the value of the property.

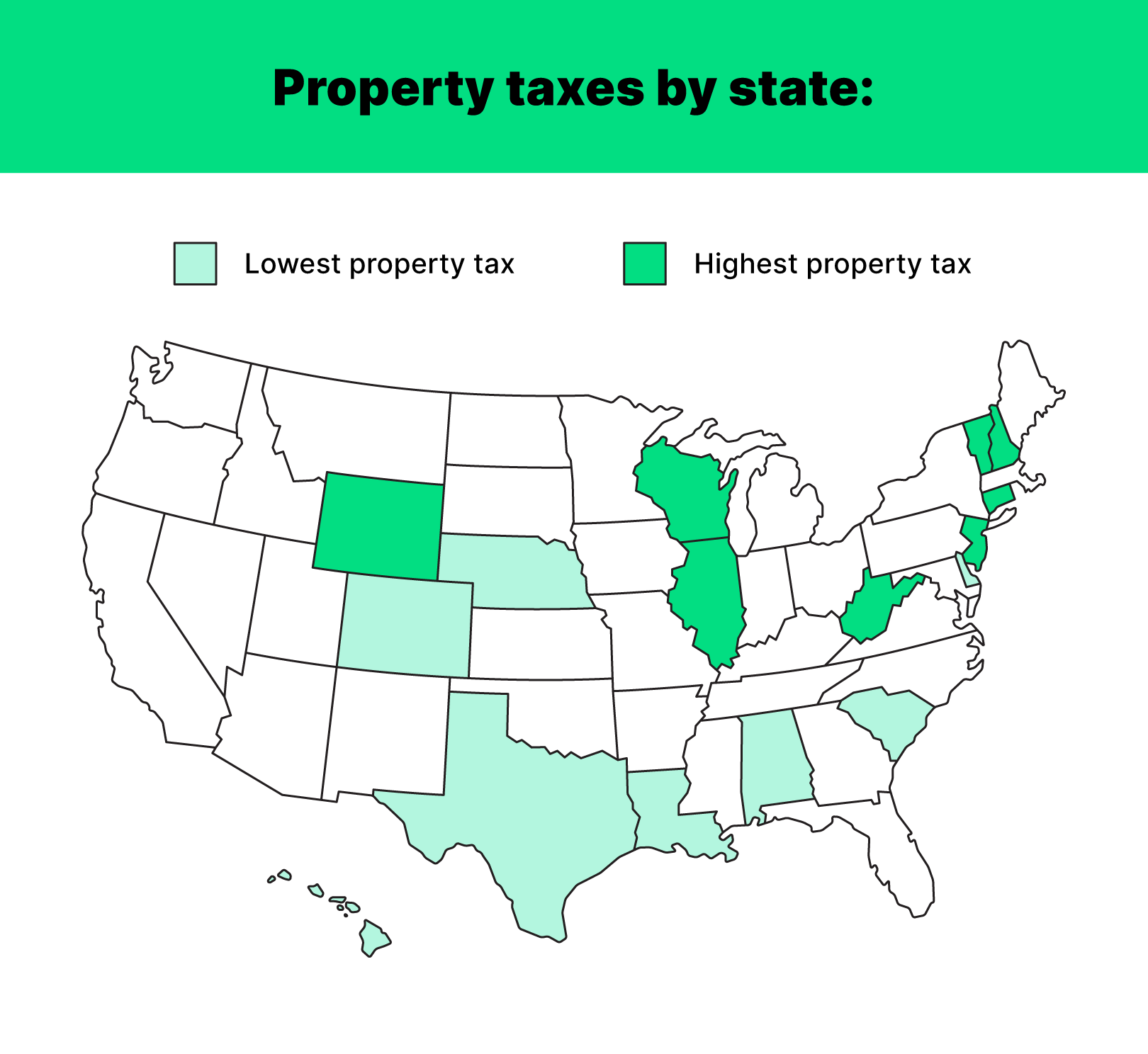

How much you pay in taxes depends on your homes value and your governments tax rate. Do you pay property tax monthly. Your property taxes are included in your monthly home loan payments.

Homeowners insurance is not included in your mortgage its an insurance policy thats completely separate from your loan agreement. Apply Now With Rocket Mortgage. Its A Match Made In Heaven.

For most types of loans taxes are included in your mortgage payment. Were Americas 1 Online Lender. FHA VA Conventional HARP And Jumbo Mortgages Available.

Although it may not be a top priority you may wonder if your property taxes are included in your monthly mortgage payments. Browse Information at NerdWallet. The value of property is determined by the assessor of each municipality in which the property is located.

15-Year Vs 30-Year Mortgage Calculator Mortgage. The amount each homeowner pays per year varies depending on. 10 hours agoIf you were shopping last year when mortgage rates were around 3 youd be looking at monthly principal and interest not including insurance or taxes of about 1350.

Principal interest and taxes are all included in the monthly mortgage payment. Monthly mortgage payment is 1007 and yearly prop taxes are 2200. Lenders often require you to pay for.

Lender Mortgage Rates Have Been At Historic Lows. Im pretty sure it shows the monthly average. Ad Looking For A Mortgage.

This should answer your question are property taxes included. Are Property Taxes Included in Mortgage Payments. Property taxes are paid every year to your state and municipality.

Compare Mortgage Options Calculate Payments. If your home is worth 250000 and your tax rate is 1 your annual bill will be 2500. Condoco-op fees or homeowners association dues are usually paid directly to the homeowners association HOA and are not included in the payment you make to your mortgage servicer.

The property tax is usually included in the mortgage payments together with the homeowners insurance interest and principal. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding. The most likely answer is yes but you should.

The amount each homeowner must pay each year varies. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. 1 day agoThey include taxes that come out of an employees pay plus costs you cover for federal state and local programs.

Are Property Taxes Included In Mortgage Payments. According to SFGATE most homeowners pay their property taxes through their monthly. Ad Americas 1 Online Lender.

If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. Property taxes are included in mortgage payments for most homeowners. A mortgage payment that includes taxes is advantageous because you are not required to make.

The median annual property tax bill in the US. The tax rate is set. The answer to that usually is yes.

Property tax is included in most mortgage payments. Mortgage borrowers must include taxes and insurance payments in their monthly mortgage payment for deposit in an escrow account.

It Could Lower Your Cost Of Housing By Saving On Property Taxes Insurance Utilities And Selling House Property Tax Cash Out

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer

Secured Property Taxes Treasurer Tax Collector

Mortgage The Components Of A Mortgage Payment Wells Fargo

Property Tax How To Calculate Local Considerations

Your Guide To Property Taxes Hippo

Is Property Tax Included In My Mortgage Moneytips

Your Guide To Property Taxes Hippo

The Time Is Drawing Near Property Taxes Are Due April 10th Propertytax Property Tax Mortgage Loans Money Finance Property Tax What Is Property Tax

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

What Is A Homestead Exemption And How Does It Work Lendingtree

Mortgage Escrow What You Need To Know Forbes Advisor

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate